Highly Compensated Employee 401k 2025

BlogHighly Compensated Employee 401k 2025 - 2025 Irs Highly Compensated Employee Tandy Florence, The 401 (k) employee contribution limit for 2025 is $23,000. 401k Contribution Limits 2025 For Highly Compensated Employees Toma, If you're age 50 or.

2025 Irs Highly Compensated Employee Tandy Florence, The 401 (k) employee contribution limit for 2025 is $23,000.

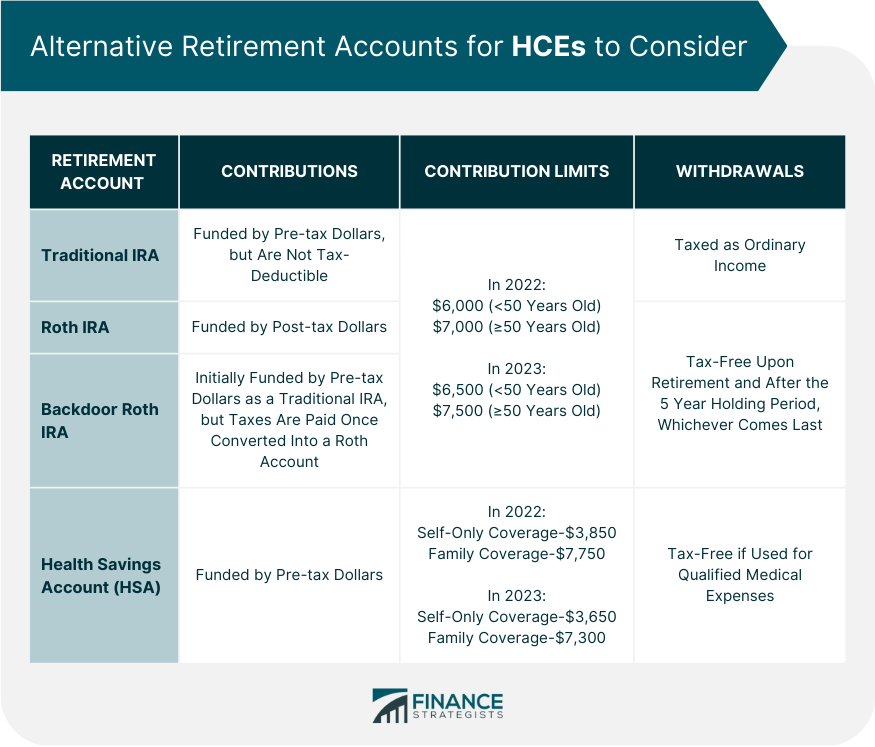

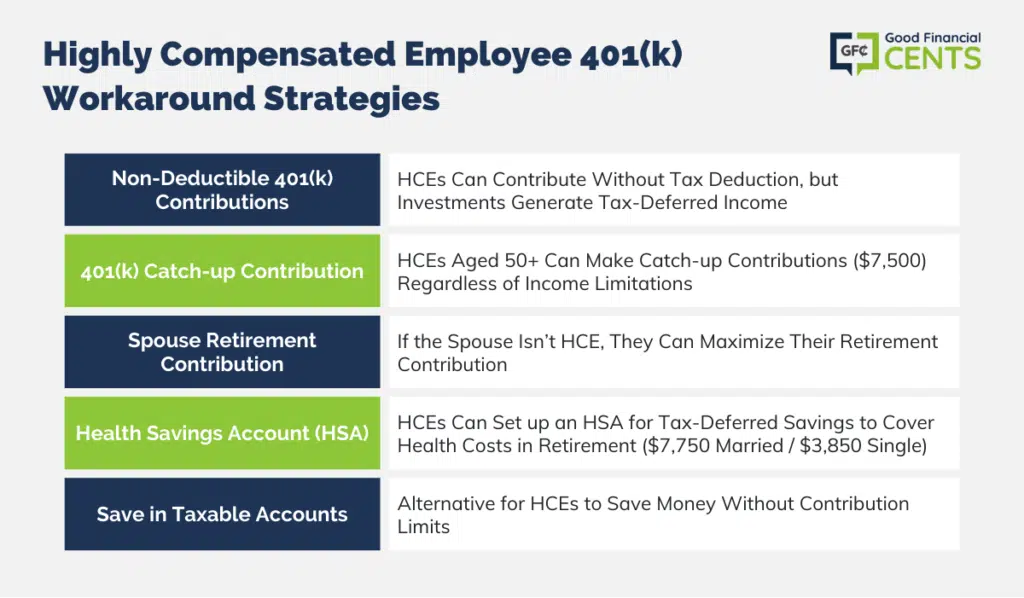

Highly Compensated Employee 2025 Limit Denny Felicle, If you are lucky enough to be a highly compensated employee (hce), you’ll quickly learn that there are restrictions on how much you can contribute to your 401(k).

401K Plan Rules for Highly Compensated Employees The Ultimate HCE Guide, The limit on elective deferrals under 401(k), 403(b), and eligible 457(b) plans increased to $23,000.

401k Limits 2025 Table Liv Alexandra, If you're age 50 or.

What Is A Highly Compensated Employee 2025 Eden Anallise, Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

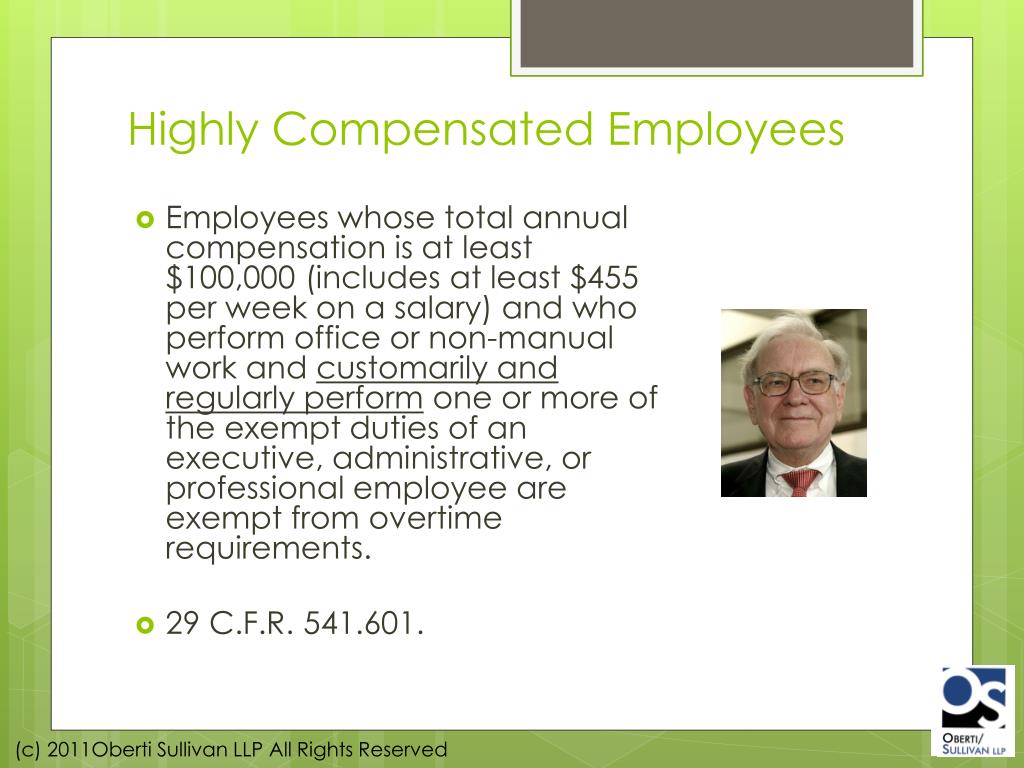

The total contribution limit, including. An hce can be defined as an employee who owned more than 5% of the company at any time during the year (or the year before).

2025 Irs Highly Compensated Employee Ronny Auguste, Unless your plan terms provide otherwise, the salary (elective) deferral limit is applied.

401k Contribution Limits 2025 For Highly Compensated Employees Toma, If you are lucky enough to be a highly compensated employee (hce), you’ll quickly learn that there are restrictions on how much you can contribute to your 401(k).

Highly Compensated Employee 2025 Definition Aurel Caresse, We explain what an hce is and how to get around these limits.

Highly Compensated 401k Year 2025 Nanny Libbie, If your employer limits your contribution because you’re a highly compensated employee (hce), the minimum compensation to be counted as an hce.

Highly Compensated Employee 401k 2025. Final thoughts on 401k limits for highly compensated employees. The main attraction of 401 (k) plans is the amount you can contribute;